Relocating international talent to the Netherlands comes with many opportunities—but also tax responsibilities that can seem overwhelming at first. The Dutch tax system is structured around a unique “box” system, categorizing different types of income, each with its own tax rules and rates.

For HR professionals, this means ensuring every package is compliant and easy to explain. For international employees, it’s about understanding how their salary, shares, and savings will be taxed in a new country.

At EMG, we support both sides of the journey. We work closely with employers and international employees to take the stress out of Dutch tax rules. In this guide, you’ll find everything you need to know for 2025: deadlines, new tax rates, the updated 30% ruling, and practical tips to keep your people supported, informed, and compliant—all the way.

Dutch Tax Calendar & Key Deadlines for Employers

The Dutch tax year follows the calendar year: 1 January to 31 December.

Here are the deadlines for 2025 (for income earned in 2024):

✅ 1 March 2025 – Filing window opens

✅ 1 April 2025 – File by this date to get your assessment by 1 July

✅ 1 May 2025 – Final deadline to submit

✅ 1 September 2025 – Last day to file if you’ve requested an extension (“uitstel”)

Late filings without an approved extension can lead to penalties.

How the Dutch Income Tax Box System Works in 2025

The Dutch tax system splits income into three categories—or “boxes.”

HR professionals don’t need to become tax experts, but understanding these basics will help when discussing net salary, onboarding compliance, and setting clear expectations with new hires.

If you’re an expat, it determines how your income—from salary to shares to savings—is taxed.

Here’s a quick overview to help you understand the basics and ask the right questions when it counts:

Box 1: Income from Employment and Homeownership

Applies to most expats. Includes salary, freelance income, pensions, and housing-related deductions.

2025 Tax Rates:

- Up to €38,441: 35.82%

- €38,441 to €76,817: 37.48%

- Over €76,817: 49.50%

Common deductions: Mortgage interest, medical costs, education expenses.

Why it matters: Helps determine net pay, benefits structure, and payroll withholding.

Box 2: Substantial Interest (5%+ Ownership in a Company)

Relevant for employees who own 5% or more of shares in a private company—such as startup founders, key executives, or international hires with equity packages.

2025 Tax Rates:

- Up to €67,804: 24.5%

- Over €67,804: 31%

Why it matters: Impacts equity compensation and founder income planning.

▪ Box 3: Savings and Investments

Applies to personal wealth like savings, rental properties, and stock portfolios. Rather than taxing actual gains, the system estimates a theoretical return on those assets.

2025 Rate: 36% on deemed returns (with tax-free allowances).

Why it matters: For high-earning expats, Box 3 can trigger unexpected liabilities.

Resident vs Non-Resident Tax Rules for Expats

Your tax liability in the Netherlands depends on your residency status:

- Residents pay tax on worldwide income.

- Non-residents are taxed on Dutch-sourced income only.

⚠️ Important change in 2025: Expats using the 30% ruling can no longer opt for partial non-resident status. That means they’re taxed on everything—including foreign shares and savings.

Why it matters: This change impacts net compensation and relocation packages. HR teams should align with payroll and tax advisors to reflect the full scope of taxation.

Extensions and Appeals

- Filing Extension: If more time is needed, expats can request a postponement from the Belastingdienst before 1 May to avoid penalties. This typically extends the deadline to 1 September.

- Objections & Appeals: If there is a disagreement with the tax assessment, expats can file an official objection (“bezwaar”) within 6 weeks of the decision letter. This process must include a clear explanation and supporting documentation.

Why it matters: Delays and miscommunications don’t need to derail the relocation experience. Having systems in place—and a trusted partner—can help everyone stay on track.

The 30% Ruling: A Sweet Deal from the Dutch Tax System to Expats

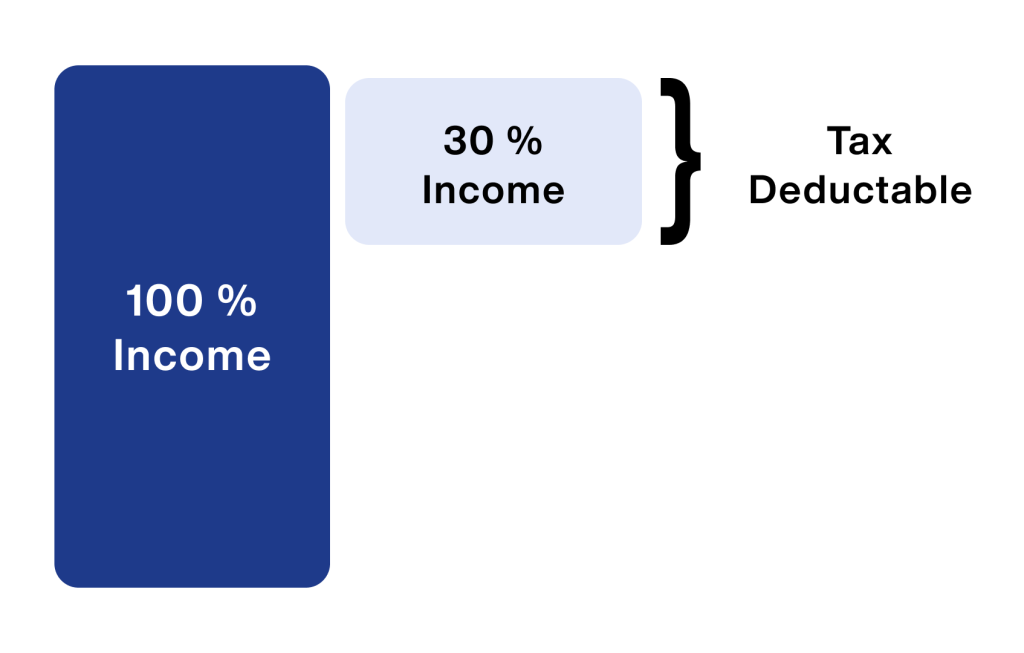

The 30% ruling has long helped employers attract top international talent. It allows a portion of an expat’s salary to be paid tax-free to offset relocation costs.

Here’s what’s changing:

✅ Capped Benefit: Tax-free income is now limited to 30% of the Balkenende norm, which is €73,800 in 2025 (€22,140 max benefit).

✅ Partial Foreign Taxpayer Status Eliminated: All income—even from foreign assets—is now taxable in the Netherlands.

✅ Coming in 2027: The tax-free percentage will drop to 27%.

Why it matters: Whether you’re offering packages to new hires or supporting employees mid-way through a ruling term, these updates impact cost planning and retention conversations.

HR Checklist for Tax Season

Here’s how to stay ahead:

- ✅ Register with Belastingdienst early for access to tax communications.

- ✅ Prepare documentation: payslips, ruling letters, bank records, etc.

- ✅ Track legislative updates, especially changes to the 30% ruling and Box 3.

- ✅ Work with a trusted tax advisor for complex or international cases.

Looking to expand your team in the Netherlands?

Ensure compliance and streamline yourinternational hiring with EMG.